The State of the Economy

Message boards :

Politics :

The State of the Economy

Message board moderation

Previous · 1 · 2 · 3 · 4 · 5 · Next

| Author | Message |

|---|---|

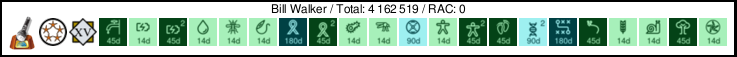

Bill Walker Bill Walker Send message Joined: 4 Sep 99 Posts: 3868 Credit: 2,697,267 RAC: 0

|

Know how factory orders or durable goods sales are going? I think there is a lot of pent up demand that will break loose some time this year. Those metrics don't mean as much in Canada,as our economy is still largely based on resource exploitation (oil, wood, minerals, etc.). A big chunk of this is exported, so we will pick up when the rest of you get around to buying all this stuff again. To paraphrase the hot dog guy in the Simpsons, thank God for China. They're putting my kids through college! Still, there are some points of light here and there. GM Canada is adding back some cancelled shifts at some Canadian plants over the next few months, but again this is just a sign that we are moving from really really bad to really bad.

|

Blurf Blurf Send message Joined: 2 Sep 06 Posts: 8962 Credit: 12,678,685 RAC: 0

|

Funny thing...lots of people here are out of work (I'm blessed to be stable in my work) but I'm seeing lots of part-time jobs available. Some which pay *EXTREMELY* well for part-time standards. I know people need benefits and all but isn't SOME job better than none??   |

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

Funny thing...lots of people here are out of work (I'm blessed to be stable in my work) but I'm seeing lots of part-time jobs available. Some which pay *EXTREMELY* well for part-time standards. They are certainly better than nothing! I'm curious, what type of temp jobs? Tech jobs? Clerical? Manufacturing? Thank you! |

skildude skildude Send message Joined: 4 Oct 00 Posts: 9541 Credit: 50,759,529 RAC: 60

|

unless of course you are receiving food stamps and public aid while out of work. then that part time job turns into a loss of food and healthcare  In a rich man's house there is no place to spit but his face. Diogenes Of Sinope |

Bill Walker Bill Walker Send message Joined: 4 Sep 99 Posts: 3868 Credit: 2,697,267 RAC: 0

|

Canada has been going to part time jobs in a big way over the last few years, at all skill levels and pay levels. The employers love it because it is so much easier to hire and fire on short notice, and benefit costs are lower. The employees put up with it because sometimes there is no choice. Of course, universal health care makes it a lot easier for the employee to swallow. Ironic that a "pinko" policy like universal health care can benefit the employer! Also, some (but not all) Canadian welfare payments cut back on a sliding scale when you start to get extra income. It's known locally as "workfare". The theory is that your benefits won't go away entirely until your other income makes you better off, but there seems to be much discussion about whether or not this is true. Fortunately, I've never had to find out the hard way.

|

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

Happy Friday! Things are looking better. Anyone seeing August sales beat July's ? Bernanke says US economy on cusp of recovery JACKSON, Wyoming – Federal Reserve Chairman Ben Bernanke declared Friday that the U.S. economy is on the verge of a long-awaited recovery after enduring a brutal recession and the worst financial crisis since the Great Depression. Economic activity in both the U.S. and around the world appears to be "leveling out," and "the prospects for a return to growth in the near term appear good," Bernanke said in a speech at an annual Fed conference in Jackson Hole, Wyo. The more upbeat assessment was consistent with the Fed's observations earlier this month as it took a small step toward pulling back some emergency programs to revive the economy. Still, Bernanke stressed Friday that despite much progress in stabilizing financial markets and trying to bust through credit clogs, consumers and businesses are still having trouble getting loans. The situation is not back to normal, he said. Restoring the free flow of credit is a critical component to a lasting recovery. |

skildude skildude Send message Joined: 4 Oct 00 Posts: 9541 Credit: 50,759,529 RAC: 60

|

I take August sales with a grain of salt. You have back to school sales and the Cash for clunkers which sold 450,000 cars. they 2 thing will probably skew these numbers. I'd even bet the numbers look great against the aug 08 numbers  In a rich man's house there is no place to spit but his face. Diogenes Of Sinope |

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

I take August sales with a grain of salt. You have back to school sales and the Cash for clunkers which sold 450,000 cars. they 2 thing will probably skew these numbers. I'd even bet the numbers look great against the aug 08 numbers I would rather see info on commercial and industrial sales is you have any. Everyone knows back to school sales have been slow. Care sales will take a dive when the C.A.R.S. is over. |

|

malignantpoodle Send message Joined: 3 Feb 09 Posts: 205 Credit: 421,416 RAC: 0

|

First and foremost, it has been a money grab for people at the top. Conspiracy theory would be to say that it was planned that way. But the reality is that a huge transfer of wealth went from government to business that did next to no good. Second, employment is the single best indicator of the status of an economy. Unemployment is precisely why so many of these states are having budget shortfalls. It's the reason for the gap in California, Georgia, heck almost anywhere. People don't make money, they don't spend. When they don't spend and don't have income, states along with the federal government lose tax revenue. You can not have a inverse correlation between the GDP and unemployment when the GDP rises. GDP cannot rise or even stabilize when job loss and unemployment in general is ongoing. When you have auto manufacturing comprising 20% of your retail sales that posts losses for 19 months straight, you cannot have a rising GDP. So it is safe to say that looking at employment is an accurate indication of the state of the economy. As far as GS claiming there to be a turn around, why wouldn't they? After all, they got 12.9B in bailout money, then paid 14B out in bonuses, with Henry Paulson being both the CEO of GS and then the secretary of the treasury under GW. Come on! I'm no conspiracy theorist but that looks like a money grab to me. |

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

The transfer of wealth you mention must mean the so called 'stimulus plan' discussed in other threads. Second, most economists would disagree about using unemployment as the "single best indicator of the status of an economy". That is simply not true and you can find this in any economics book. Lastly, this thread is about the Economy turning around, not the proper use of economic indicators. Do you have personal or first hand info you would like to share? The Gross Domestic Product is used to measure economic activity and thus is both procyclical and a coincident economic indicator. The Implicit Price Deflator is a measure of inflation. Inflation is procyclical as it tends to rise during booms and falls during periods of economic weakness. Measures of inflation are also coincident indicators. Consumption and consumer spending are also procyclical and coincident. |

|

malignantpoodle Send message Joined: 3 Feb 09 Posts: 205 Credit: 421,416 RAC: 0

|

Lastly, this thread is about the Economy turning around, not the proper use of economic indicators. Do you have personal or first hand info you would like to share? How are you going to discuss the economy without discussing economic indicators? This doesn't make any sense, unless of course the purpose of this thread was to have people come along and simply agree with you that the economy is turning around. The transfer of wealth you mention must mean the so called 'stimulus plan' discussed in other threads. Actually, I'm referring to the transfer of wealth discussed on this thread by several other people that you reflected as well. In any case, there is a direct correlation between rising unemployment and a falling GDP as already outlined. You cannot have accelerated unemployment with rising GDP. As your definition points out, the employment rate is procyclic. Well so is the GDP. "Procyclic: A procyclic (or procyclical) economic indicator is one that moves in the same direction as the economy. So if the economy is doing well, this number is usually increasing, whereas if we're in a recession this indicator is decreasing. The Gross Domestic Product (GDP) is an example of a procyclic economic indicator." So yeah, let's talk about the economy turning around. In a nutshell, it isn't. If we're measuring it on GDP, then GDP is falling as well. http://www.bea.gov/newsreleases/national/gdp/gdpnewsrelease.htm As a matter of fact, that .gov website lists the following as a source for predictions in the falling GDP; "Bureau of Labor Statistics (BLS) Quarterly Census of Employment and Wages (QCEW)" But answer me this question; how are we supposed to discuss "the economy turning around" without discussing economic indicators? Economic indicators aside, what instead should we be basing our conclusions on; faith, best wishes, and happy thoughts? Or, should we just listen to Ben Bernanke that originally stated that the economic downturn was the fault of panicked investors while praising the central banks for saving the day? Bernanke blames investors, praises banks I'm just curious how we're substantiating this economic turnaround. Going back to the topic of this thread; are there people out there who have seen real change in the market? I have a bit of experience here, so I'll comment on it. The short answer is yes and no. I have a measly $3000 in a brokerage account that I play with. When the downturn hit, I was down to $1100 after a couple of weeks' time. I was not invested in blue chips or cyclical stocks. I was in countercyclical mid-cap companies. Friends in the market consistently told me not to try to catch a falling knife, but my portfolio value was falling like a stone. I decided to get involved. I sold and took the $1100 cash and began investing in other companies. I made money off of AIG because I bought in at $8/share and sold the next day at $10. I then went to Microsoft and bought in at $23something and sold at $24soemthing. I bought in to ABAT at $3.37 and sold at $3.86. I kept doing this kind of thing over and over, lots of trades, cautiously investing at the right time and then selling after a week, sometimes a day, sometimes the same day. Long story short, I have worked it back up and now am into google for $2,845. So yes, I've had turn around, but only with extreme luck peppered with a savvy move here and there. None of these gains are real though, as most of the companies I bought and sold in are lower than what I sold at today. So from that perspective, the market has not turned around for me. I have seen turn around, but not due to real value in the market, just playing the tiny ebbs and flows which can be done in any economy. |

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

Lastly, this thread is about the Economy turning around, not the proper use of economic indicators. I said the use of economic indicators. I did not intend this to be about which indicators are best for measuring the health of the economy. You use the words "unemploment" and "employment" interchangably. They are two seperate things. One is a percentage and the latter is the number of people employed. You also believe that the unemployment rate is the best way to measure the health of an economy. There are lots of ways to accomplish this it also depends on why you need the information and what you are using for. Economists do not use Unemployment for this purpose because the health of the labor market is only a part of the economy. It does not take into consideration things like production utilization or the length of the workweek. Unemploment might be going up at the same time people are working more overtime, etc. You are entitled to your opinion pertaining to GDP. I am not going to go further with this side discussion. Thank you for the last part of your post. That is more in line with the topic at hand. I would; however, recommend holding on to your investments for a longer period of time and diversifying a bit. Perhaps a few stocks in each major market sector. |

|

malignantpoodle Send message Joined: 3 Feb 09 Posts: 205 Credit: 421,416 RAC: 0

|

I am not using employment and unemployment interchangeably. When I brought up unemployment, you posted a piece on employment rates being procyclic. I merely pointed out that the GDP (your choice indicator) is procyclic as well. I said the use of economic indicators. I did not intend this to be about which indicators are best for measuring the health of the economy. It goes hand in hand. Discussing the use of economic indicators, and which indicators, is how anybody that requires substantiation forecasts the state of the economy. You also believe that the unemployment rate is the best way to measure the health of an economy. I believe that no single factor is all telling. But I also know that many economists judge the economy based on employment and unemployment rates. I can provide many links which I'm sure you're not interested in, but if I'm wrong, let me know and I'll post as many as you like, including essays where unemployment is being used as the biggest factor in describing a current economic situation. Thank you for the last part of your post. That is more in line with the topic at hand. I would; however, recommend holding on to your investments for a longer period of time and diversifying a bit. Perhaps a few stocks in each major market sector. Why? If I were doing this I'd have even less money now. The one and only reason that I made most of my money back was not trying to ride things out. You're talking about standard long term investment strategies used in a regular market during a financial crisis. Besides, when you're only dealing with $3000, diversification involves too much overhead. To do what you're talking about would involve an initial 5-8% loss just on brokerage fees and the bid/ask spread alone, not to mention having to jump out of some bad ones driving the costs up higher. If I wanted to take a blind, shotgun approach and ride it as long as I can, I'll just go to a casino and play blackjack with it where the house only has a 2% advantage. However, in a normal market your advice makes sense. But right now, that isn't working for anyone. Most of the growth in the market is based upon normal ebb and flows, and hype. A falling GDP and rising unemployment (they go hand in hand) does not account for real economic growth in the market. Let me give you a good example; AMD shares are up 9% right now. Out of the blue. But why? Because Citigroup changed their status from "hold" to "buy". Why did they do this? Because they DISAGREE with AMD's own conservative earnings estimates. That's right, AMD posts conservative estimates, and C comes around and says, "nah, it's too conservative". People buy, demand increases, shares go up. But what growth has taken place? None, yet anyway. And that's my point. If you want to make money in the market right now, you've got to play the hype. If on the other hand you want to take the traditional investment strategy with a falling GDP and rising unemployment while still on the back end of a recession, then maybe, in a few years, you could weather the storm. Or not... ask those that held WAMU or Wachovia, or General Motors, or Bear Stearns... or me, that is down on mcz for $800 or Cross Atlantic Commodities for $400 that never came back. The long term, diversified approach wins when there is real, substantiated, maintained growth. That is not happening right now though. If we consider $1100 to be my initial investment (because that's when I started "playing" the market), then I have an almost 200% gain overall, and at that rate close to 1000% return annually (which is a bit unrealistic because I'd have to continue being very lucky and the economic situation would have to remain exactly as it is now which is unlikely). The best mutual funds (diversified, long term investment funds) in a bull market get you 13-15% annually. I'll stick with what I'm doing for now. Oh and hey; I'm not trying to attack you or fight, just discuss/debate civilly. If I've come off harsh, it was not my intention. I also got to the thread kind of late and ended up commenting on several things in the thread after the fact. But seriously, my only intention is to have a stimulating discussion, not offend, so if I have I apologize. Best wishes! |

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

You also believe that the unemployment rate is the best way to measure the health of an economy. I do not doubt there are multiple sources out there. Meanwhile, I do agree with what you are saying, and I understand that there are multiple ways to study the economy. Thank you for the last part of your post. That is more in line with the topic at hand. I would; however, recommend holding on to your investments for a longer period of time and diversifying a bit. Perhaps a few stocks in each major market sector. I have never thought mutual funds were good investments. If one wanted to have a broad position offered by a fund, someone could buy the same stocks themselved that are offered in the fund. However, some people are unwilling to do this so they let others handle that for them (for a price). Everyone should stick with what works for them and stays within their own tolerance for risk, imo. What works best for me is a small selection of stocks that I feel are positioned best to outperform the market. Some are doing better than ohers but overall they are doing well so far this year. Oh and hey; I'm not trying to attack you or fight, just discuss/debate civilly. If I've come off harsh, it was not my intention. I also got to the thread kind of late and ended up commenting on several things in the thread after the fact. But seriously, my only intention is to have a stimulating discussion, not offend, so if I have I apologize. Best wishes! You have not offended, and I apologize if I sounded cranky. Thank you for contributing. It's mush better discussing these things with you than with myself. Best to you as well! |

|

malignantpoodle Send message Joined: 3 Feb 09 Posts: 205 Credit: 421,416 RAC: 0

|

I do not doubt there are multiple sources out there. Meanwhile, I do agree with what you are saying, and I understand that there are multiple ways to study the economy. So much of economics is hypothetical. The only thing for sure is the bottom line. And of course, add to that the profit potential of successfully predicting economic situations and you have a field with serious contention and differing strategies we're left with a situation where there will always be a little bit of fact complimented with a little bit of speculation. I have never thought mutual funds were good investments. If one wanted to have a broad position offered by a fund, someone could buy the same stocks themselved that are offered in the fund. I totally agree. I could point out that the specific investments mutual funds partake in are a trade secret therefore I couldn't just read about say, Oppenheimer funds and then just invest parallel to their endeavors, but one could review the large caps and their % held by institution numbers and go from there. However, there is too much waste in mutual funds, as everyone involved has to make money and only pays capital gains after that has been subtracted. Then again many fail, such as Legg Mason losing 50% this year alone. I'm with you in that mutual funds are not the choice investment, and a well researched, savvy, and a little bit lucky investor could do far better on their own. You have not offended, and I apologize if I sounded cranky. You weren't cranky at all. Passionate, but not cranky. Most of us are this way. In any case, I think we'll find common ground in realizing that 1. the economy WILL recover sooner or later, and that 2. we are all hoping for it. Whatever the case, I enjoy these threads on this forum because seti@home produces a higher quality of people, such as yourself, than most other forums do. |

Bill Walker Bill Walker Send message Joined: 4 Sep 99 Posts: 3868 Credit: 2,697,267 RAC: 0

|

Here is another economic indicator to add to the mix. Interesting that the story expressely states that retail sales "don't lead the recovery like the stock market, but are considered by economists to be an important economic indicator."

|

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

Here is another economic indicator to add to the mix. Interesting that the story expressely states that retail sales "don't lead the recovery like the stock market, but are considered by economists to be an important economic indicator." Like when you are trying to monitor consumer sentiment. If people are more upbeat about the economy, they usually spend more. Higher retail sales somtimes lead to stronger durable goods sales etc. And those lead to more factory orders, eventually. |

Bill Walker Bill Walker Send message Joined: 4 Sep 99 Posts: 3868 Credit: 2,697,267 RAC: 0

|

Here is another economic indicator to add to the mix. Interesting that the story expressely states that retail sales "don't lead the recovery like the stock market, but are considered by economists to be an important economic indicator." .. but first you have to empty your shipping department, the warehouses, and the dealer's back yard. (Based on my many years working for machinery manufacturers.) The good news is that even a downward trend in this "pipeline" inventory can make it easier for the manufacturers to get bank loans for product development and capitol upgrades, even before the economic upturn results in new orders at the factory.

|

|

malignantpoodle Send message Joined: 3 Feb 09 Posts: 205 Credit: 421,416 RAC: 0

|

oh and don't forget, the tax revenue that government gets every time money changes hands :P |

Bill Walker Bill Walker Send message Joined: 4 Sep 99 Posts: 3868 Credit: 2,697,267 RAC: 0

|

Another, indirect,indication that the economy is at least bottoming, if not even heading back up. BMO results buoy TSX For those of you not following the Canadian econmy too closly, BMO is the Bank of Montreal, one of the biggest banks here, and TSX is the Toronto Stock Exchange, the biggest exchange in Canada and home to most of our blue chips. The three biggest single things that drive the TSX numbers are Canadian bank results, the world price of oil, and the state of the US economy (our biggest single customer). The decrease in BMO's loan loss provisions is probably as much from tightening new loans as it is from any improvement in the economy. As a result the private indivdual or small business trying to get a loan will not see much of an immediate change, but at least our big banks seem to have made it through the worst of the current $hit$torm, without government bailouts.

|

©2024 University of California

SETI@home and Astropulse are funded by grants from the National Science Foundation, NASA, and donations from SETI@home volunteers. AstroPulse is funded in part by the NSF through grant AST-0307956.