The State of the Economy

Message boards :

Politics :

The State of the Economy

Message board moderation

Previous · 1 · 2 · 3 · 4 · 5 · Next

| Author | Message |

|---|---|

|

malignantpoodle Send message Joined: 3 Feb 09 Posts: 205 Credit: 421,416 RAC: 0

|

It was the private sector that got us into this mess and I think that overall we need more regulation to help ensure that this doesn't happen in the future, or continue to keep happening. Private entities should not have so much control over so many peoples' lives. Many that want the government to stay out of things take the perspective of not wanting control being levied over them, but still fail to realize that there will always be control; either in the private sector or from the government. Short of public ownership, it will either be private enterprise or government in control. Considering the state of affairs, there needs to be diversified control. That means private enterprise is allowed to continue, but with strict government oversight and regulation in place. |

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

It was the private sector that got us into this mess and I think that overall we need more regulation to help ensure that this doesn't happen in the future, or continue to keep happening. Perhaps the private companies are getting too big and the entire market is dominated by just a few corporations? I am reluctant to believe that governmant can do a better job. I also believe the federal reserve and their slow reaction to a faltering economy had a big impact on the recession. Not to mention the home mortgage mess where almost everyone has a share of the blame, from lenders to investors, government officials and homeowners. The economy was floating on debt that all of a sudden dropped out from under it. |

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

Another, indirect,indication that the economy is at least bottoming, if not even heading back up. Yet another indication. It is good to see home sales recover, home values have a big impact on how wealthy people feel. The better paople feel about their own situation, the more they participate in the market (spending and investing). U.S. Economy: Home Sales Exceed Forecasts, Goods Orders Rise By Shobhana Chandra and Courtney Schlisserman Aug. 26 (Bloomberg) -- Purchases of new homes in the U.S. jumped more than forecast and demand for long-lasting goods such as autos and computers climbed, reinforcing signs the economy is rebounding from the worst recession since the 1930s. Home sales increased 9.6 percent in July, the most in four years, to a 433,000 annual pace, figures from the Commerce Department showed today in Washington. Another report from the department indicated bookings for durable goods climbed 4.9 percent, also exceeding forecasts and the most since July 2007.  |

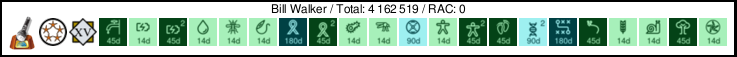

Bill Walker Bill Walker Send message Joined: 4 Sep 99 Posts: 3868 Credit: 2,697,267 RAC: 0

|

Don't have a quick link to post, but several commentators in Canada have recently noted that the home owner real estate market has clearly bottomed and is rebounding, but commercial real estate continues to drop monthly. Possibly a sign of the reluctance of banks to loan to businesses, while home prices had reached an unrealistic low, and the banks are now ready to once again take on the risk of having to repossess your house. At least, here in Canada.

|

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

Don't have a quick link to post, but several commentators in Canada have recently noted that the home owner real estate market has clearly bottomed and is rebounding, but commercial real estate continues to drop monthly. Possibly a sign of the reluctance of banks to loan to businesses, while home prices had reached an unrealistic low, and the banks are now ready to once again take on the risk of having to repossess your house. At least, here in Canada. We pretty much have the same situation. Some areas are doing better than others. It seems most of the gain in new home sales is due to sales in the north east. |

skildude skildude Send message Joined: 4 Oct 00 Posts: 9541 Credit: 50,759,529 RAC: 60

|

one reason for commercial prices is that the biggest commerical retail owners are going bankrupt. these individuals own the largest malls and store spaces in america. with so much debt tied up in these few real estate holding companies and their current woes in bankruptcy brings down commercial value even more. they companies did the same thing people did. They paid way to much for property on the assumption that the price would always increase in value.  In a rich man's house there is no place to spit but his face. Diogenes Of Sinope |

|

malignantpoodle Send message Joined: 3 Feb 09 Posts: 205 Credit: 421,416 RAC: 0

|

I want to break this down a bit and reflect on several points which have been amalgamated yet I feel are separate issues. Perhaps the private companies are getting too big and the entire market is dominated by just a few corporations? I am reluctant to believe that governmant can do a better job. But how do you keep companies from getting too big? Regulation. Whether dominated by a few corporations or many, the fact that we're at the mercy of private enterprise is the problem. How that private enterprise is structured doesn't really matter. You believe the government can't do better. I believe they couldn't do worse. I also believe the federal reserve and their slow reaction to a faltering economy had a big impact on the recession. Look at what you're saying here; if the blame lies with the federal reserve and their slow reaction, then you're saying ultimately that lack of regulation is the problem. You're putting the blame on failure of regulation. We agree. Not to mention the home mortgage mess where almost everyone has a share of the blame, from lenders to investors, government officials and homeowners. I wholeheartedly disagree. The only people that are to blame in the mortgage mess are the lenders. It's a well established fact that banks lent to ineligible people for the purpose of reselling the investments as a mortgage backed security. The poor person applied for a home and got it. The investor bought the mortgage backed security which has been a reliable, long term investment for the last 40 years running, and the government officials allowed the banks to determine their own standards of business. Nobody, and I mean NOBODY in this mess is at fault except for the lenders that deliberately sold debt that they and only they knew couldn't be repaid. Not the investors, not the public. The economy was floating on debt that all of a sudden dropped out from under it. Not really. Debt is an actualized loss. The economy was floating on false profits and unrealized gain. Hype. Bad investment. It was not floating on debt. It is NOW floating on debt. |

skildude skildude Send message Joined: 4 Oct 00 Posts: 9541 Credit: 50,759,529 RAC: 60

|

technically it wasn't "real" banks that made the bad loans. The ciompanies at fault were mortgage brokers. they made all the dirty deals and manipulated the system to their will. when the well dried up they went back under the slimy rocks from which they came. Needless to say these brokers sold their newly created loans to banking institutions. banking institutions assumed these were valid loans. this makes it partially their fault. Banks should have taken a moment to check on the loans they were buying. then to add fuel to the fire they made these loans a commodity to buy and sell. So bad loans were bundled with good loans and sold like cattle.  In a rich man's house there is no place to spit but his face. Diogenes Of Sinope |

|

HAL Send message Joined: 28 Mar 03 Posts: 704 Credit: 870,617 RAC: 0

|

The slant I get on this IMHO is that what we need is to have SOMEONE kick the money changers out of the temple AGAIN! |

|

malignantpoodle Send message Joined: 3 Feb 09 Posts: 205 Credit: 421,416 RAC: 0

|

Quite true, that's why I blame the "lenders" because that is comprised of both banks and mortgage brokers. Banks still account for over 30% of mortgage lending through their retail channels. And it was banks that resold the MBS to investment firms. What this all shows to me is that traditionally safe investing is not always safe. We have blue chip DJIA stocks crash and are taken off of the Dow overnight. Traditionally secure investments like a MBS are now one of the worst investments you could be involved in with an institution. I know for a fact (and I think you'll agree) that this was not the fault of investors as Bernanke had originally cited. An investor's responsibility to a publicly traded company is to provide capital. That's it. If people have invested in you, be it a publicly traded company or an investment firm, then they have responsibility (in many cases well defined, legal responsibilities) to the investors. To make matters worse, I heard today that the FDIC is getting low on money. There were what, something like 81 bank failures for 2009 alone? CNN said something about the FDIC having only 20% of the capital it had at the start of the year. Word gets out that eventually if banks keep failing, that the FDIC won't be able to insure your accounts, and watch people pull out (myself included) and witness a real economic collapse happen so fast your head will spin. |

Byron S Goodgame Byron S Goodgame Send message Joined: 16 Jan 06 Posts: 1145 Credit: 3,936,993 RAC: 0

|

To make matters worse, I heard today that the FDIC is getting low on money. There were what, something like 81 bank failures for 2009 alone? CNN said something about the FDIC having only 20% of the capital it had at the start of the year. Word gets out that eventually if banks keep failing, that the FDIC won't be able to insure your accounts, and watch people pull out (myself included) and witness a real economic collapse happen so fast your head will spin. FDIC might sink into red by end of year |

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

One, the FDIC is backed by the federal government and congress is prepared to provide funding if need be (it is what they do best). I want to propose a possible motivation for banks making bad loans. This does not shift blame but simply points out a contributing factor. In a 2002 study exploring the relationship between the CRA and lending looked at as predatory, Kathleen C. Engel and Patricia A. McCoy noted that banks could receive CRA credit by lending or brokering loans in lower-income areas that would be considered a risk for ordinary lending practices. CRA regulated banks may also inadvertently facilitate these lending practices by financing lenders. They also noted that CRA regulations, as then administered and carried out by Fannie Mae and Freddie MAC, did not penalize banks that engaged in these lending practices. They recommended that the federal agencies use the CRA to sanction behavior that either directly or indirectly increased predatory lending practices by lowering the CRA rating of any bank that facilitated in these lending practices.[95] |

Byron S Goodgame Byron S Goodgame Send message Joined: 16 Jan 06 Posts: 1145 Credit: 3,936,993 RAC: 0

|

FDIC eases rules for private buys of failed banks Doesn't seem like the best idea to me, though it does also say

|

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

As a manufacturer, I especially like seeing news like this. Now if only we could get our customers to plan ahead. Everything is ordered so late and every order is hot rush. Purchasers’ Index Rose More Than Forecast Aug. 31 (Bloomberg) -- Business activity in the U.S. rose more than forecast in August, adding to signs the economy is improving. The Institute for Supply Management-Chicago Inc. said today its business barometer increased to 50, the highest level since September, from 43.4 in July. A reading of 50 is the dividing line between contraction and expansion. Automakers are likely to be at the epicenter of a rebound in manufacturing over coming months as assembly lines speed up after the government’s “cash-for-clunkers†plan left dealer lots bare. Increasing demand from overseas and a record reduction in inventories mean a pickup in factory orders and production may last for much of the rest of the year. It’s “a manufacturing-led recovery,†said Robert Stein, a senior economist at First Trust Advisors in Lisle, Illinois. “Much of this is probably related to the revival in auto production over the past month or so.†Economists surveyed by Bloomberg News forecast the index would rise to 48, according to the median of 53 projections. Estimates ranged from 46 to 52.5. |

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

Good news from Canada! I wonder where these new jobs are being created... Anyone know? Canada Posts First Job Gain in Four Months on Finance By Greg Quinn Sept. 4 (Bloomberg) -- Canada recorded a surprise job gain in August, the first in four months, suggesting the country is emerging from its first recession since 1992. Employment rose by 27,100, Statistics Canada said. The jobless rate increased to 8.7 percent from July’s 8.6 percent, the highest since January 1998, as the labor force grew faster than employment. Economists surveyed by Bloomberg predicted a job loss of 15,000 and unemployment at 8.8 percent. “The number was well above consensus,†said Jack Spitz, managing director of foreign exchange at National Bank of Canada in Toronto. “It certainly suggests an improvement. It’s not necessarily a defining moment in Canadian job creation, but it certainly suggests a more bullish direction for the Canadian economy and by extension, the Canadian dollar.†The Canadian currency advanced 0.7 percent to C$1.0948 per U.S. dollar at 7:30 a.m. in Toronto, compared with C$1.1019 yesterday. One Canadian dollar purchases 91.34 U.S. cents. |

|

malignantpoodle Send message Joined: 3 Feb 09 Posts: 205 Credit: 421,416 RAC: 0

|

Highest unemployment in 26 years here in the US as of a couple of days ago. |

skildude skildude Send message Joined: 4 Oct 00 Posts: 9541 Credit: 50,759,529 RAC: 60

|

Highest since 83 and the report concluded that the stimulus package saved about 500,000 jobs so it could have been much worse  In a rich man's house there is no place to spit but his face. Diogenes Of Sinope |

|

malignantpoodle Send message Joined: 3 Feb 09 Posts: 205 Credit: 421,416 RAC: 0

|

Since 83, 26 years, same thing. I'm not talking against the stimulus, just continuing the conversation about whether or not the economy is turning around. |

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

Since 83, 26 years, same thing. Do you think it is? I certianly hope it does not get worse. I am also worried that any gains we have might be hampered by inflation (thanks to deficit spending). The long term health of the US economy depends in part on the strength of the dollar. Even gold is over $1000 per oz. |

skildude skildude Send message Joined: 4 Oct 00 Posts: 9541 Credit: 50,759,529 RAC: 60

|

I'm still worried about the approximately 1 million homes that are about to be foreclosed upon. This really doesnt bode well for an economy or the people that are supposed to be working at recovering the economy  In a rich man's house there is no place to spit but his face. Diogenes Of Sinope |

©2024 University of California

SETI@home and Astropulse are funded by grants from the National Science Foundation, NASA, and donations from SETI@home volunteers. AstroPulse is funded in part by the NSF through grant AST-0307956.