The State of the Economy

Message boards :

Politics :

The State of the Economy

Message board moderation

| Author | Message |

|---|---|

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

I'm starting to read positive news from around the world that the recession is nearing an end. What do you think? Are we really improving? If so, where are we headed? Goldman Sachs’s Cohen Says Recession Is Ending ‘Now’ Aug. 17 (Bloomberg) -- The U.S. recession is ending “right now,†said Abby Joseph Cohen, a senior investment strategist at Goldman Sachs Group Inc. The economy may grow by 3 percent in the next couple of quarters and expand by 1.5 percent to 2 percent next year, Cohen said. While consumer spending is likely to rise, it probably won’t increase as fast as at the end of prior periods when the U.S. was emerging from a recession, she said. “Clearly the economy is on the mend,†Cohen said in an interview with Bloomberg Radio. “We do think that profit growth will be more substantial going forward.†|

skildude skildude Send message Joined: 4 Oct 00 Posts: 9541 Credit: 50,759,529 RAC: 60

|

the stock market had other plans today. FYI the DJI dropped 2% and world markets took a hit as well. the fear being that the markets bounced back to quickly and the recession still hasn't ran its course. further indications are the jobs situation. there aren't any jobs. then theirs the minimum wage increase that occurred last week which makes retailers and food processors not to want to hire many people. next is the cost of food. remember how it rocketed up when diesel and gasoline prices spiked? their still up there even after fuel prices have long since dropped. this leads me to assume either suppliers or retailers are gouging the consumer again. since the consumer gets gouged on the necessities we have less to spend on the little extra luxuries we like. that being said retailers are shooting themselves in the foot by actually gouging the consumer. the cash for clunkers is going great if you're not GM Ford or Chrysler. Seems the Japanese did it to us again. American car manufacturers just don't have the market for small fuel efficient cars. Perhaps its time for the chevy chevette to be reborn. I owned a banana yellow chevette. my pickup line was wanna go for a ride in my 'vette. needless to say women weren't amused at the site of my little car. I was amused to see how shallow women could be. yet I digress Goldman sachs can say the recession is over that way they can start handing out massive bonuses to the uber rich while those that lost their jobs can get warm by the light of their sterno can in their new cardboard condo.  In a rich man's house there is no place to spit but his face. Diogenes Of Sinope |

Robert Waite Robert Waite Send message Joined: 23 Oct 07 Posts: 2417 Credit: 18,192,122 RAC: 59

|

It's a jobless recovery. The truth is jobs are still being lost at a rate of tens of thousands a month in the states. The controllers of information, who have all increased their personal fortunes during this time, would like us to believe that our troubles are over because the job losses have slowed down. There is no recovery. The patient is still bleeding. I'm curious how the elites plan on staging this great recovery they speak of after closing the plants and factories, shipping all the machinery in those plants overseas and firing every working person under their employ? Vive le revolution! |

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

Goldman sachs can say the recession is over that way they can start handing out massive bonuses to the uber rich while those that lost their jobs can get warm by the light of their sterno can in their new cardboard condo. Wow... seriously? Yes, the economy is turning around. Even the Chinese economy is expected to grow more than 7% this year. Not to mention the europeans... Euro Gains Against Dollar, Yen on Optimism Recession Is Easing Aug. 18 (Bloomberg) -- The euro rose against the yen and the dollar before a report economists said will show German investor confidence advanced this month, adding to signs the global recession is abating. The 16-nation currency advanced the most in more than a week against the yen as a Bloomberg News survey indicates the ZEW Center for European Economic Research in Mannheim today will report its index of investor and analyst expectations climbed to 45 this month from 39.5 in July. The euro also advanced versus the dollar before a government report that may show U.S. housing starts rose for a third week, lifting demand for higher-yielding currencies.[/b] |

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

It's a jobless recovery. The truth is jobs are still being lost at a rate of tens of thousands a month in the states. Which is it? A jobless recovery or no recovery? More importantly, what is wrong with a little optimism? I start a thread suggesting the recession may be abating and all I hear is doom and gloom. |

Robert Waite Robert Waite Send message Joined: 23 Oct 07 Posts: 2417 Credit: 18,192,122 RAC: 59

|

You are witnessing probably the greatest money grab in history. The recovery is the transfer of wealth from the poor, the working class and the middle class to the portfolios of the wealthiest 1%. Those at the top of the economic pile are making out like bandits while the rest of us are sinking further with less hope of getting into a lifeboat. It's my belief that the upbeat reporting is simply a ploy to drive people further into debt by increasing their personal spending or to attempt to wring a few dollars more from people by making them believe that there's a fortune to be made by playing in the cesspool known as the stock exchange. I personally am not buying the recovery stories, just as I'm not buying any big ticket items in the forseeable future. I'm dumping debts as fast as I can and will keep driving my 17 year old Jeep until it falls apart under me. I believe the reports of economic recovery to be a hoax. There is no industrial base to build on in the US. You've allowed your elites to move your manufacturing overseas. You've allowed your elites the freedom to move capital anywhere in the world with no Tobin tax. You've allowed your elites to restrict the movement of people, ensuring a virtual labour force of slaves in the countries you use to do your manufacturing. I'm not an economist, but I don't see anything that supports the claims of recovery. |

Byron S Goodgame Byron S Goodgame Send message Joined: 16 Jan 06 Posts: 1145 Credit: 3,936,993 RAC: 0

|

It doesn't surprise me at all that GS came out and said the recovery is on, since IMO they are part of what I consider to be the "money grab". There is an interesting video about some of what has happened currently in what was described by William K. Black ( the former litigation director of the Federal Home Loan Bank Board who investigated the Savings and Loan disaster of the 1980s) as a vast transfer of wealth from the poor and middle class. Don’t Ask: Don’t Tell This Economic Disaster |

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

It doesn't surprise me at all that GS came out and said the recovery is on, since IMO they are part of what I consider to be the "money grab". There is an interesting video about some of what has happened currently in what was described by William K. Black ( the former litigation director of the Federal Home Loan Bank Board who investigated the Savings and Loan disaster of the 1980s) as a vast transfer of wealth from the poor and middle class. This money grab is a conspiracy theory... It is no secret that invsetors are doing well thanks to the recovery in the worldwide stock market. You make a better point than Robert. I agree GS is a biased source since they are in the business of selling investment vehicles. Yet they are correct in pointing out the recovery is starting. Manufacturing activity is on the rise, productivity is up and even automakers are adding overtime to keep up with demand (although shortlived). While the economy might be doing much worse in areas where some of us live (Canada), there is plenty of good news out there. Stocks, Metals Rally as German Confidence Indicates Recovery By Stuart Wallace Aug. 18 (Bloomberg) -- European stocks and U.S. futures advanced and industrial metals gained on a bigger-than-forecast increase in German investor confidence and speculation a government report will show U.S. housing starts climbed. The MSCI World Index of 23 developed nations added 0.4 percent at 11:10 a.m. in London, rebounding from its biggest retreat since April. Futures on the Standard & Poor’s 500 Index gained 0.6 percent. Copper added 2 percent and aluminum rose 4.1 percent on the London Metal Exchange after a two-day drop. The yen fell against all 16 most-traded currencies tracked by Bloomberg, while the dollar declined against every one except the yen and the Brazilian real. The ZEW Center for European Economic Research index of investor and analyst expectations rose to 56.1 in August from 39.5 in July, exceeding the median forecast in a Bloomberg News survey for a reading of 45. U.S. builders in July probably broke ground on homes at the fastest pace in eight months, analysts said before a report scheduled for 8:30 a.m. in Washington. |

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

More on housing starts. Looking better! Single-family home building rises for 5th month By ALAN ZIBEL, AP Real Estate Writer Alan Zibel, Ap Real Estate Writer WASHINGTON – Construction of single-family homes rose 1 percent in July, the fifth-straight monthly increase as builders poured foundations at the fastest pace since last October, the Commerce Department said Tuesday.  |

Byron S Goodgame Byron S Goodgame Send message Joined: 16 Jan 06 Posts: 1145 Credit: 3,936,993 RAC: 0

|

This money grab is a conspiracy theory I guess it can be called that until the shoe drops and the investigations start that are inevitable IMO. Hopefully Black and those working with him in the Houses as well as others are successful in making that happen sooner than later. It seems to me the fraud amounts to trillions in liars loans that are just now starting to be looked at and realized for what they are. I think as time goes by more attention will be given to it by the government and at the very least some regulation should be put back in place and enforced to keep it from happening again. Hopefully you're right about the recovery, time will tell if it's going to be solid or just temporary. I'm hoping for the best, but realize too that those that got us to the bad situation we're in are still in charge. Edit: some grammer. |

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

Going back to the topic of this thread; are there people out there who have seen real change in the market? Since I work in the primary metals industry, I have direct communcation with manufacturers. For the most part a majority of our customers had a very good month last month. I hoping the trend continues. I know, there are plenty of people still out of work. We cannot be satisfied untill those who want to work have jobs. Anyway, happy hump day! |

skildude skildude Send message Joined: 4 Oct 00 Posts: 9541 Credit: 50,759,529 RAC: 60

|

as reported a few weeks ago from the white house, it may take years to get jobs back to where they were before. It's inevitable that Businesses are going to be extremely cautious for the near future. I don't see a recovery I still see a great deal of people that are getting even more desperate. Just an FYI decreases in unemployment claims can man 2 things 1) people are getting back to work, or 2) people have run out of benefits and are no longer considered unemployed. This is the trick in the system. They've changed the playing field and nobody noticed. back in the great depression, if you were able to work and you didn't have a job you were unemployed. today if you are able to work and are not receiveing unemployment benefits you are not counted. So if they say the number is 7, 8 ,9% then guaranteed its higher than that  In a rich man's house there is no place to spit but his face. Diogenes Of Sinope |

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

as reported a few weeks ago from the white house, it may take years to get jobs back to where they were before. I would not use unemployment to guage how the economy is doing for a number of reasons. Some of whech you mention above. GDP and GDP per capita are bothe better at guaging how things are doing. This does not maen umemployment is inconsequential, rather GDP is a moer accurate measure of economic activity. I believe that many paople are waiting for the economy to recover before they start spending money again. If only we had more good news and more optomism we mighth have a faster recovery. There is claerly a spychological aspect at work here. Since no one tell we are out of a recession untill six months after it happens, we very well be out of our current recession. (as defined by an increase in GDP) U.S. Recession May Have Ended in June, Goldman’s McKelvey Says By Carlos Torres Aug. 19 (Bloomberg) -- The worst U.S. recession since the 1930s may already be over, according to Edward McKelvey, a senior economist at Goldman Sachs Group Inc. in New York. The gain in industrial production in July, the first in nine months, and the likelihood that output will continue to grow because of depleted inventories is “the best†signal that the contraction is over, McKelvey wrote in an e-mail to clients yesterday. The Business Cycle Dating Committee of the National Bureau of Economic Research, the Cambridge, Massachusetts-based private research group charged with calling turns in the economy, determined the current downturn started in December 2007. A June trough means the contraction would have lasted 18 months, making it the longest since the Great Depression. |

skildude skildude Send message Joined: 4 Oct 00 Posts: 9541 Credit: 50,759,529 RAC: 60

|

we are a consumer economy. unemployed people not only hurt but the economy hurts with them. when Unemployment rises people buy less and therefore the economy falters. so yes the employment rate is a wonderful indicator of how the economy is doing.  In a rich man's house there is no place to spit but his face. Diogenes Of Sinope |

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

we are a consumer economy. unemployed people not only hurt but the economy hurts with them. when Unemployment rises people buy less and therefore the economy falters. so yes the employment rate is a wonderful indicator of how the economy is doing. It is a good indicator just not the most accurate. Economists will use GDP first. For instance, immigration can cause unemployment to go up, does this mean the economy suffers when the population increases? If people retire or otherwise leave the workforce and unemployment goes down, does this mean the economy is doing better? Unemplyment is better for measuring the health of the labor market. The Gross Domestic Product is used to measure economic activity and thus is both procyclical and a coincident economic indicator. The Implicit Price Deflator is a measure of inflation. Inflation is procyclical as it tends to rise during booms and falls during periods of economic weakness. Measures of inflation are also coincident indicators. Consumption and consumer spending are also procyclical and coincident. |

skildude skildude Send message Joined: 4 Oct 00 Posts: 9541 Credit: 50,759,529 RAC: 60

|

And isn't this how they didn't see we were in a recession. If I recall the stock market tanked, unemployment skyrocketed, sales tax revenue dropped, corporate profits(outside exxon/bp) tanked. then several months later we heard the GDP dropped that seems and is a bit late out of the gate.  In a rich man's house there is no place to spit but his face. Diogenes Of Sinope |

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

And isn't this how they didn't see we were in a recession. If I recall the stock market tanked, unemployment skyrocketed, sales tax revenue dropped, corporate profits(outside exxon/bp) tanked. then several months later we heard the GDP dropped that seems and is a bit late out of the gate. Yes, there is a lag. That doesn't diminish the importance of GDP growth though. |

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

Yes, there is a lag. That doesn't diminish the importance of GDP growth though. Speaking of GDP growth: More good news to chew on. Leading Economic Index May Show U.S. Recession Is Close to Over Economists surveyed by Bloomberg this month said the economy will grow at an average 2.1 percent pace in the second half of this year after contracting over the previous 12 months. |

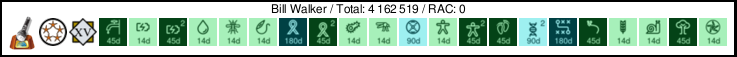

Bill Walker Bill Walker Send message Joined: 4 Sep 99 Posts: 3868 Credit: 2,697,267 RAC: 0

|

A lot of the Canadian papers and TV commentators seem to have a hard time grasping that "recession" has a formal definition (two consecutive quarters of economic shrinkage), and the end of the recession only means that the terms of the definition are no longer strictly met. They apparently think the economy has only two possible states, "Recession" and "everything is just swell". In fact, the recession is over here, but that just means the economy has moved from sucks extremely to simply sucks. Slightly less hard times are still here, and will be for awhile.

|

StormKing StormKing Send message Joined: 6 Nov 00 Posts: 456 Credit: 2,887,579 RAC: 0

|

A lot of the Canadian papers and TV commentators seem to have a hard time grasping that "recession" has a formal definition (two consecutive quarters of economic shrinkage), and the end of the recession only means that the terms of the definition are no longer strictly met. They apparently think the economy has only two possible states, "Recession" and "everything is just swell". Same here in the states. The formal definition is harly ever used aprtly because so many people do not know what GDP is or why it is important. "slightly less hard times" is good way of describing the conditions here as well. But we will recover, eventually. Know how factory orders or durable goods sales are going? I think there is a lot of pent up demand that will break loose some time this year. |

©2025 University of California

SETI@home and Astropulse are funded by grants from the National Science Foundation, NASA, and donations from SETI@home volunteers. AstroPulse is funded in part by the NSF through grant AST-0307956.